Finding travel and health insurance for bicycle touring is a bumpy ride. Reading through the long policy documents and figuring out any possible situation where the coverage might not work always gives me a headache. Last year, when I quit my job (again) to travel by bike and work as a freelancer, I found SafetyWing travel insurance. It seemed like there was finally a perfect product for me. But after a year, I realised there was a fine print that would leave me without coverage.

Having learned from this experience, I decided to write this article about why SafetyWing is not a good insurance for bicycle touring. I will also give you some advice to help you avoid making the same mistake.

My expectations for a long-term bicycle touring travel insurance

A year ago, I decided to quit my job and start travelling full-time again, sometimes by bike, sometimes without it. I knew I would have to return to my country of residence (Poland) every couple of months. At that point, I didn’t have a job or health insurance at home.

That’s why the key things I was looking for in my travel insurance were:

- It should cover long trips

- It should give me flexibility. I didn’t have a precise plan for my trips as in the post-pandemic world of 2022, it was still challenging to be sure of anything

- It would ideally give me some coverage in my country of residence.

Especially the last point seemed hard to achieve. The insurance provider I used during my first solo bike tour five years ago (a polish company PZU), didn’t give me coverage after returning to Poland.

When I heard of SafetyWing – a travel and health insurance for nomads giving you 30 days of coverage in your home country for every 90 days you spend abroad – I was convinced it was a perfect match for me.

My story with SafetyWing

Before signing up, I read the insurance policy several times, meticulously analysing the part about sports and activities excluded from the coverage. The list included a bunch of extreme and contact sports like paragliding, kite-surfing, boxing or running with the bulls, but cycling or even mountain biking wasn’t on the list.

I took it as a confirmation that bicycle touring was covered by the insurance. I also saw other travel bloggers recommending SafetyWing as insurance for bicycle touring, so I decided to purchase their policy.

For a year, I didn’t have to make a claim. Luckily. Because if I got injured or sick during one of my bicycle tours, SafetyWing would refuse to cover my treatment.

\

I found out about it by accident. As my situation changed and I had regular health insurance in my home country again, I was looking for cheaper alternatives without coverage at home. On one of the Facebook groups for bicycle tourers, I found a comment from someone who claimed SafetyWing didn’t cover bicycle touring.

Alarmed, I decided to check with their customer service.

Their reply was:

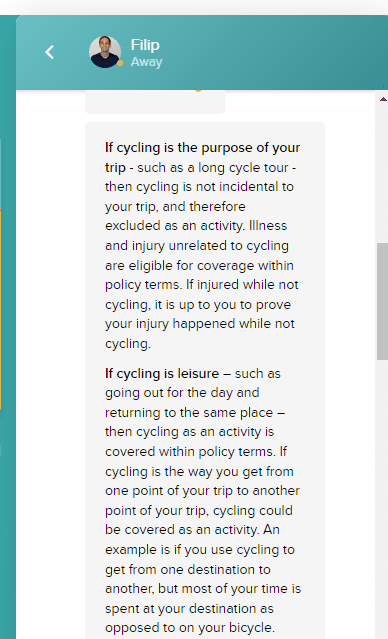

After my follow-up questions, they also confirmed that any trip other than a day trip is excluded from the policy. Turns out, I overlooked one word when studying the policy conditions: incidental.

If bicycle touring is the main purpose of your trip (or one of the main purposes), SafetyWing won’t cover you.

It doesn’t mean SafetyWing isn’t good travel insurance. It’s just not meant for bicycle touring.

Is SafetyWing good insurance for digital nomads?

If your trips don’t include bicycle touring, and you’re spending many months working remotely, SafetyWing can be a good fit for you. Their biggest advantage is:

- Flexibility. You pay for insurance renewal each month instead of buying the policy for the whole year. If you’re like me and don’t like to commit, it’s a perfect solution. You don’t need to know beforehand how long your trip will be, and you don’t need to pay for months of travel insurance if you decide to return home earlier.

- Possibility to buy the policy when you’re already abroad. Did it ever happen to you that you completely forgot to buy your travel insurance and only realised it after a few days abroad? Most insurance companies only allow you to purchase insurance when you’re still in your country of residence. SafetyWing doesn’t care where you are. You can buy their insurance from the other side of the world.

- They offer 30 days of coverage in your country after 90 days you’ve spent abroad. If you quit your job and have no health insurance at home, it gives you a safety pillow for the first days after you return.

How to find travel insurance for bicycle touring?

The clear conclusion from my SafetyWing fuckup is that buying travel insurance for bicycle touring is a minefield. It’s easy to overlook one crucial line or word and end up without coverage. How to prevent that?

- Ask fellow bicycle tourers about their experience. You can find many Facebook, Reddit or Telegram groups with people who have already tested a certain insurance company. But don’t rely on their opinions 100 %.

- Don’t rely on the information you find in blog articles either. The policy conditions might have changed, your situation might be different than other people’s, or the author might have misunderstood the conditions (they should verify it, of course, but mistakes happen and it’s your responsibility to ensure you will be covered).

- Look for travel insurance providers that offer special coverage for active travellers. Check out also companies offering cycling insurance. I won’t recommend any specific companies here, as it highly depends on your country of residence.

- When reading through the policy documents, don’t just rely on the list of excluded activities and sports. Check what type of travelling is actually covered. Is it just for short trips or for the long term? Is there a clause about how many days you can stay in your home country after a certain period abroad? Are there any countries or regions that are not included? What about preexisting conditions?

- A quick call or e-mail to the insurance company might help allay any doubts. Describe your situation as precisely as possible, and ask about any exceptions.

As usual another great post. I agree. I no longer use any travel insurance. The fine print as usual. Stopped using in 2019. And the clauses just got more complicatated after the “panic”demic. Although insurance companies were smart enough to include epidemics in there exclude list years ago.

DM

awesome